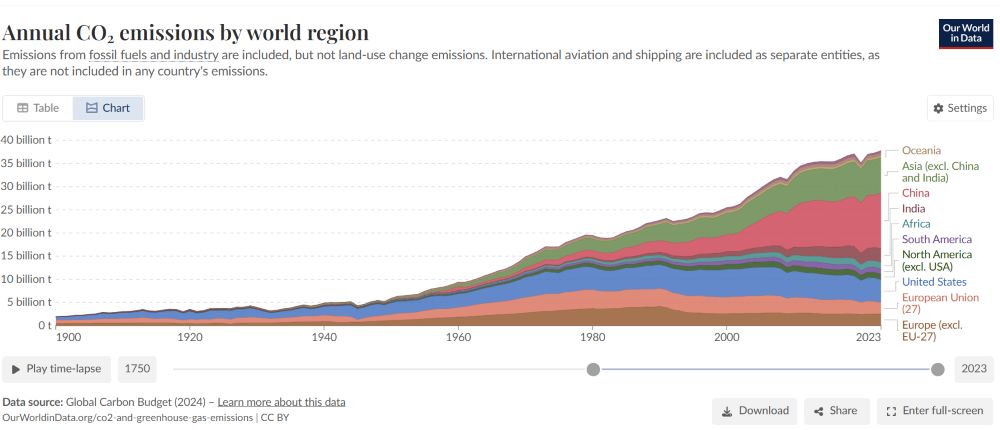

Today’s climate action community includes Third Act, a group that organizes volunteers over age 60 to halt climate change. One of its main campaigns is pushing big banks to disinvest in fossil fuels.

When I was a reporter during the 1980s, a major social change effort was disinvestment in the apartheid system of South Africa. An op ed by Zeb Larson in the Los Angeles Times pointed out in 2022 how that disinvestment goal found success, and why climate activists might want to use it as a model.

“It’s no coincidence that the movement gained strength quickly in churches and on college campuses: Whether or not you could stop apartheid, profiting from it was immoral…Divestment created tangible targets for people to organize around and against that were also specific to where they lived: university pension boards, church investment boards and local governments. Lobbying these organizations was effective and helped the movement to spread across the country.”

Asking older Americans with financial assets to sign its pledge to withdraw funds from big banks, Third Act’s website states, “If you have $62,500 in the mainstream banking system, your money is producing more carbon that the average American does in 6 months!” Given how the financial system works, the deposits that individuals keep in banks can be used by those banks to loan money to businesses. Explaining its rationale, Third Act says, “Despite the climate crisis, our biggest banks are huge funders of coal and gas and oil companies. In the years since the Paris climate accords, they have given more than three trillion dollars in loans to these companies, even as scientists have told us we must stop the expansion of this industry.”

Even those who agree with Third Act do not find it simple to take the action that the group urges older individuals to take. As Al Gore’s film title states, the reason to move all your bank accounts is another example of “An Inconvenient Truth.” Third Act recommends starting by cancelling big bank credit cards and opening credit card accounts with financial institutions whose investment policies align with your climate action values. Next steps would include finding preferable checking and savings accounts.

Through webinars and other online resources, including a platform called Bank for Good, the organization guides climate activists toward its recommendations for “Responsible Finance.” On that platform, you can select criteria you desire in a bank account, including online banking, ATM access, travel benefits, and local community investment by resources like credit unions and CDFIs. Another nonprofit that offers guidance is Green America, a 40-year-old organization that focuses on finance that supports environmental and social justice goals.

Third Act acknowledges the personal and emotional interest that each of us may have when considering our money, and that there is no “one size fits all.” Chase, Citibank, Wells Fargo, and Bank of America are the main big institutions that concern those who hope to halt lending to the fossil fuel industry. A younger activist cited in one of Third Act’s webinars said, “I got so angry when I realized the bank I was counting to protect my future was using my money to destroy my future.”

Third Act advises disinvestment activists to take time to research the best options for their financial needs and values and be cautious about moving accounts too quickly. Consider how the shift to new credit cards might affect your available credit for any pending major purchases and your credit score. Check on fees and interest rates charged. When researching banks, be sure to check whether they have online banking, ATMs, or fees for actions such as stop payments and returned check deposits.